Cryptocurrency: Understanding the Future of Money

Cryptocurrency has been making headlines in recent years, sparking both interest and confusion among investors, consumers, and financial institutions. As a relatively new concept, it’s natural to wonder what this digital phenomenon is all about. In this article, we’ll delve into the world of cryptocurrency, exploring its history, mechanics, benefits, and risks.

A Brief History of Cryptocurrency

The concept of cryptocurrency first emerged in the 1980s, but it wasn’t until the launch of Bitcoin in 2009 that this digital currency began to gain traction. Bitcoin, created by the anonymous Satoshi Nakamoto, was designed to be a peer-to-peer electronic cash system, allowing users to make transactions without the need for intermediaries like banks. Since then, over 5,000 alternative cryptocurrencies (altcoins) have been created, each with its unique features and purposes.

How Cryptocurrency Works

Cryptocurrency is a decentralized digital medium of exchange that uses cryptography to secure and verify transactions. It operates on a decentralized network, meaning that there’s no central authority controlling the flow of transactions. Transactions are recorded on a public ledger called a blockchain, which is maintained by a network of computers worldwide.

The mechanics of cryptocurrency can be broken down into the following steps:

- Transactions are initiated by a sender, who wants to transfer cryptocurrency to a recipient.

- The sender broadcasts the transaction to the network, where it’s verified by nodes on the blockchain.

- Miners, who are specialized nodes on the network, collect and group transactions into blocks.

- Miners compete to solve a complex mathematical puzzle, which locks the block into the blockchain and confirms the transactions.

- The blockchain is updated on each node, ensuring the integrity of the network and the security of transactions.

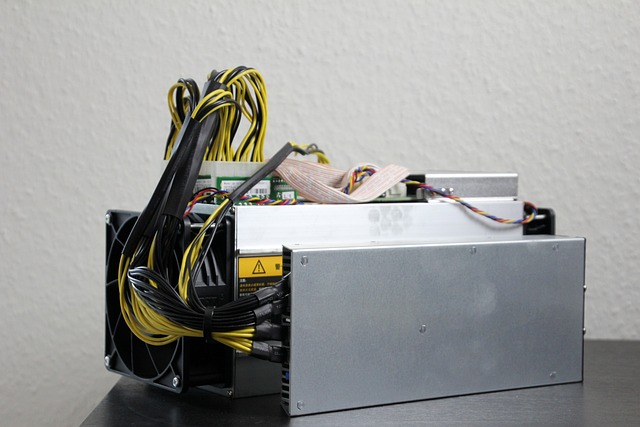

Miners and Mining

Miners play a crucial role in the cryptocurrency ecosystem, as they validate transactions and secure the network. Miners are rewarded with newly minted cryptocurrency and transaction fees for their efforts. However, the mining process requires significant computational power, energy, and resources, which can be a barrier to entry for individual miners.

Types of Cryptocurrency

With the proliferation of alternative cryptocurrencies, there are many types of cryptocurrency available. Some of the most notable ones include:

- Bitcoin (BTC): The first and most widely recognized cryptocurrency.

- Ethereum (ETH): A platform that enables the creation of smart contracts and decentralized applications (dApps).

- Litecoin (LTC): A peer-to-peer cryptocurrency designed for faster transaction processing.

- Monero (XMR): A private cryptocurrency that emphasizes anonymity and security.

Tokenization

In addition to cryptocurrency, tokenization is another concept that has gained attention in the financial world. Tokenization refers to the process of converting real assets, such as stocks, bonds, or commodities, into digital tokens that can be traded on blockchain networks. This innovation has the potential to increase the efficiency, transparency, and accessibility of traditional financial markets.

Benefits of Cryptocurrency

Cryptocurrency offers several benefits, including:

- Decentralization and democratization of financial systems.

- Security and transparency of transactions.

- Efficient and low-cost transactions.

- Increased accessibility to financial services for underbanked populations.

Risks and Challenges

While cryptocurrency has shown significant promise, it’s not without risks and challenges:

- Volatility and price fluctuations.

- Regulatory uncertainty and lack of clear guidelines.

- Security risks and potential for hacking.

- Scalability and adoption challenges.

Regulation and Adoption

As cryptocurrency gains mainstream recognition, regulatory bodies around the world are working to develop frameworks that balance innovation with investor protection and financial stability. While some countries, like Japan and Singapore, have established clear regulations, others, like China, have taken a more restrictive approach. As regulation and adoption continue to evolve, it’s essential for investors and users to stay informed and adapt to the changing landscape.

Conclusion

Cryptocurrency has the potential to revolutionize the way we think about money and financial systems. While there are risks and challenges associated with this emerging technology, its benefits and innovations cannot be ignored. As the landscape continues to evolve, it’s essential for investors, consumers, and financial institutions to educate themselves and stay informed about the latest developments in the world of cryptocurrency.